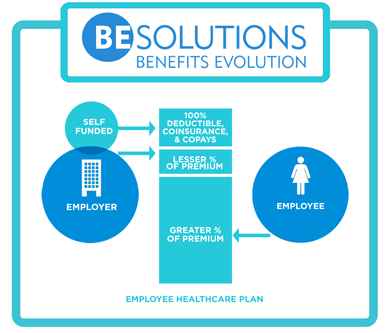

Smart-Funding is a partially self-funded structure using a primary and secondary coverage. The combination of the two coverage levels results in a traditional comprehensive health plan. Your business is the secondary coverage funder.

Smart-Funding is a partially self-funded structure using a primary and secondary coverage. The combination of the two coverage levels results in a traditional comprehensive health plan. Your business is the secondary coverage funder.

The primary coverage is a fully insured, high deductible plan that can be a PPO or a High Deductible Qualified Plan, (HDQP). The primary coverage provides several key items that enable Smart-Funding to be effective:

The primary plan determines which physicians and facilities are network and non-network providers. Where possible, the goal should be to use the current carrier as the primary to enable the members to maintain their physicians. If replacing a leased network, the current TPA can provide a provider list to determine which insurance network(s) match up the best.

Each carrier has a lifetime maximum benefit, typically in the $5 million to unlimited range.

As described in detail below, the secondary plan is a self-funded program that will reimburse providers at the negotiated primary network rate.

The secondary coverage is a self-funded program that pays for benefits underneath the high deductible of the primary plan.

You self-fund the GAP – the corridor of benefits below the primary deductible where the plan and the member share the cost.

Claims Processing

Claims ProcessingClaims are processed according to the various schedules of benefits offered by the employer.

The member is responsible for out-of-pockets – deductibles, copays and/or coinsurance. The secondary plan covers the remaining GAP until the member’s claims total reaches the primary coverage deductible. At that point, all claims are processed and paid by the primary carrier.

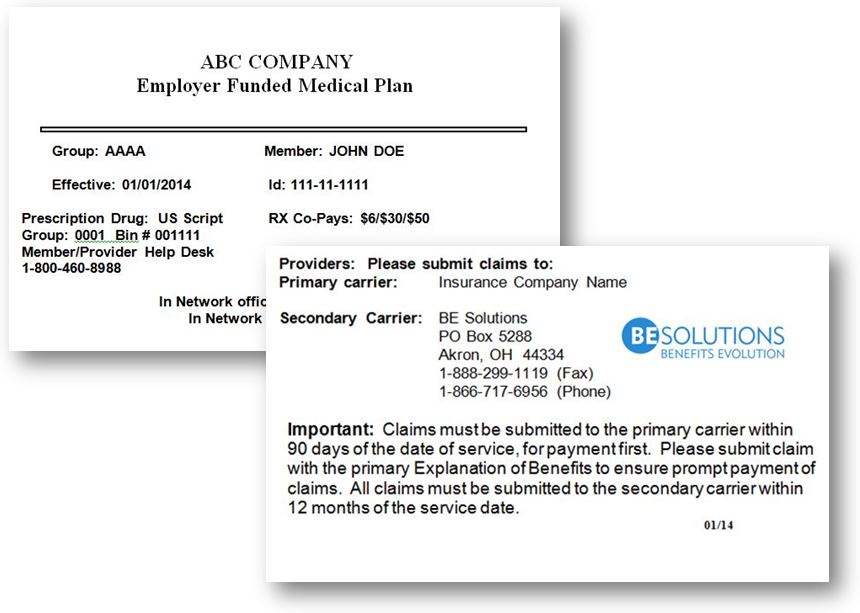

Your employees and their families will carry two benefits cards now – their primary carrier card, and a BE Solutions card like the example shown here.

When visiting a doctor, paying for prescriptions or ordering lab tests, both cards are presented.

The claims process is very simple as the existence of primary and secondary coverage is nothing new to the industry.

The providers bill the primary carrier first. The primary carrier will re-price the claims and apply it towards the member’s primary deductible. If the amount exceeds the primary deductible, the carrier will pay their portion of the claim.

The primary carrier sends an Explanation of Benefits (EOB) to the member and the provider informing them of the results of their processing. The provider then invoices the secondary plan, BE Solutions/Your Business, and BE Solutions processes down to the level of benefits represented by the member’s plan schedule. An EOB from BE Solutions will then be sent to the member and to the provider with payment. This is a normal primary / secondary process.

The primary carrier sends an Explanation of Benefits (EOB) to the member and the provider informing them of the results of their processing. The provider then invoices the secondary plan, BE Solutions/Your Business, and BE Solutions processes down to the level of benefits represented by the member’s plan schedule. An EOB from BE Solutions will then be sent to the member and to the provider with payment. This is a normal primary / secondary process.

In the event that the provider bills the member rather than the secondary coverage, BE Solutions has a customer representative that can contact the provider to submit the bill to us at no cost to the plan or the member.

BE Solutions offers online web tools for all enrollments, new hires, terminations and changes. In addition, HR personnel can search claim status and/or claim payment information using our system as well.

The most important feature of Smart-Funding is the claims and financial data collected by BE Solutions for you. This is your data as the funder for the plan.

Numerous standard and custom reports provide for effective management of the health plan. Financial and claims data allow us to be an advocate for you at renewal time. You sit at the table with the carrier, each with claims data from the previous year. Knowing how and on whom the dollars were spent facilitates a meaningful discussion as to what the existing conditions are, and where the renewal numbers should be.

Financial and claims reports enables you to evaluate plan design and plan changes. No more guessing, “How much could we save if we did this” or “How much could it cost us if we did that?” Costs associated with the current plan design and potential savings can be viewed using actual data for the group. Claims data allows you to educate your employees about proper utilization of the plan. If a change in behavior or some simple direction can save a member and the plan some money, why not take advantage.