BE Solution’s Supplemental Health Insurance Plan (SHIP) is the perfect benefits plan for local and state governments. The SHIP plan will lower the costs of your public-sector health plan while increasing the actual benefits that eligible participants receive.

BE Solution’s Supplemental Health Insurance Plan (SHIP) is the perfect benefits plan for local and state governments. The SHIP plan will lower the costs of your public-sector health plan while increasing the actual benefits that eligible participants receive.

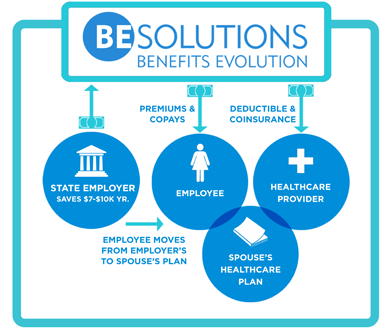

Similar to the Medical Expense Reimbursement Plan (MERP), SHIP is a government-funded health care plan that moves your married, two-income public employee off the government-sponsored benefits plan, and onto his or hers spousal benefits program.

Supplemental Health Insurance Plan (SHIP) is a tax-advantaged plan under the IRS code that reimburses you for your premiums and out-of-pocket medical expenses.

If a participant is married and his or her spouse has coverage available through his or her employer, your public-sector employee would:

If a participant is married and his or her spouse has coverage available through his or her employer, your public-sector employee would:

The public plan pays for the coverage under the participant’s spouse’s health care plan in two ways—through:

SHIP provides two types of reimbursement:

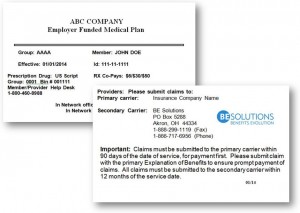

When you partner with BE Solution’s SHIP program, participants receive an easy-to-use ID card that is presented to the health care provider at the time of service, along with the ID card from your spouse’s plan (the primary plan, which pays first).

When you partner with BE Solution’s SHIP program, participants receive an easy-to-use ID card that is presented to the health care provider at the time of service, along with the ID card from your spouse’s plan (the primary plan, which pays first).

The provider will submit the participant’s claim to the spouse’s carrier first. Then the provider submits any remaining balance after the spouse’s carrier has paid to SHIP, which is administered by BE Solutions.

If you drop Family coverage and enroll your family in coverage offered by your spouse’s employer, the BE Solutions SHIP will reimburse 100% of premiums charged by your spouse’s plan to a monthly maximum of $1,000.

This is a win/win situation for both you and the State of Ohio. You get free monthly premium amounts through the SHIP premium reimbursement feature, as well as 100% reimbursement of your in-network out-of-pocket costs. The State of Ohio gets lower costs since fewer members will be in their health care plan, which translates to lower health care premiums for the State health plan, and SHIP reimbursement amounts paid out are tax free to employees and 100% tax deductible to the State. It’s that simple.

State or local government employers, and your public employees. The following participant groups best represent those that take advantage of the SHIP offering:

Many of these couples are looking to start a family. In most cases, they will max out their annual out of pocket costs for the wife as she goes through the pregnancy and birth process. Afterwards, the baby’s early years will result in utilization costs that we can reimburse at 100%.

You benefit because the risk of a premature birth or problem pregnancy are completely avoided. In addition, all pregnancy, birthing and well-baby costs will be covered by the spouse’s plan.

The wife/mother member of this group is keenly aware of the out of pocket costs associated with family health coverage. This makes her ideal in evaluating the plan benefits for her family. Females drive utilization for families. Females will see the benefit in getting 100% reimbursements for out-of-pocket costs.

You benefit because members move off the plan in blocks of three and above. You avoid the many office visits of the children, the pregnancies as the family grows and the future claims as the couple ages.

This may be our best group to move. As you know, the majority of our health claims are generated as we get older. You avoid quite a few medical claims and a lot of Rx claims when we move the older couples from the plan. They very much appreciate the reimbursements, particularly Rx co-pays that begin to add up each month as maintenance drugs become part of their daily regimen.